Investment Trends to Watch for in 2025

As we step into 2025, the investment landscape continues to evolve, shaped by technological advancements, global economic shifts, and emerging market opportunities. Whether you’re an experienced investor or just starting, staying informed about upcoming trends can help you make strategic decisions. Here are the key investment trends to keep an eye on in 2025:

1. Sustainable and ESG Investing

Environmental, Social, and Governance (ESG) factors are becoming increasingly important for investors. Companies with strong ESG practices tend to outperform their peers and attract more investment capital. In 2025, green energy, carbon-neutral technologies, and sustainability-focused startups are expected to dominate portfolios.

Key Sectors to Watch:

- Renewable energy (solar, wind, and hydrogen)

- Electric vehicles (EVs) and charging infrastructure

- Sustainable agriculture and food technologies

2. Artificial Intelligence and Automation

The rapid advancement of AI technologies is transforming industries ranging from healthcare to finance. Investors are looking at companies leveraging AI to drive innovation, streamline operations, and create new market opportunities.

Potential Investments:

- AI-powered healthcare solutions

- Robotics in manufacturing

- Data analytics and machine learning platforms

3. The Metaverse and Web3

While the concept of the metaverse is still evolving, it continues to attract attention as a potential game-changer in digital interaction. Investments in virtual reality (VR), augmented reality (AR), blockchain, and decentralized finance (DeFi) are poised to grow in 2025.

Opportunities in:

- Virtual real estate

- NFT-backed assets

- Blockchain-based gaming platforms

4. Healthcare Innovation

Healthcare remains a resilient and lucrative sector for investments. In 2025, breakthroughs in gene editing, personalized medicine, and telehealth will continue to draw investor interest. The growing global focus on health security also drives opportunities in biotechnology and medical technology.

Trends to Watch:

- CRISPR and gene therapy advancements

- AI-driven diagnostics

- Wearable health technology

5. Diversification in Emerging Markets

Emerging markets in Asia, Africa, and Latin America are becoming attractive due to their young populations and growing middle class. As these regions expand their technological and economic infrastructure, opportunities in fintech, e-commerce, and renewable energy will multiply.

Top Regions:

- Southeast Asia (e.g., Vietnam, Indonesia)

- Africa’s tech hubs (e.g., Kenya, Nigeria)

- Latin America’s fintech boom (e.g., Brazil, Mexico)

6. Real Estate in High-Growth Areas

Despite uncertainties in global real estate markets, high-growth areas such as urban centers in developing countries and tech hubs in developed economies remain attractive. Mixed-use developments and properties catering to remote work trends are gaining traction.

Investment Focus:

- Smart city projects

- Affordable housing solutions

- Commercial properties in tech-friendly regions

7. Focus on Cybersecurity

As digital transformation accelerates, cybersecurity has become a top priority for businesses and governments alike. Investments in cybersecurity companies are expected to rise as threats become more sophisticated.

Key Opportunities:

- Cloud security

- Blockchain-based security solutions

- Advanced threat detection and mitigation

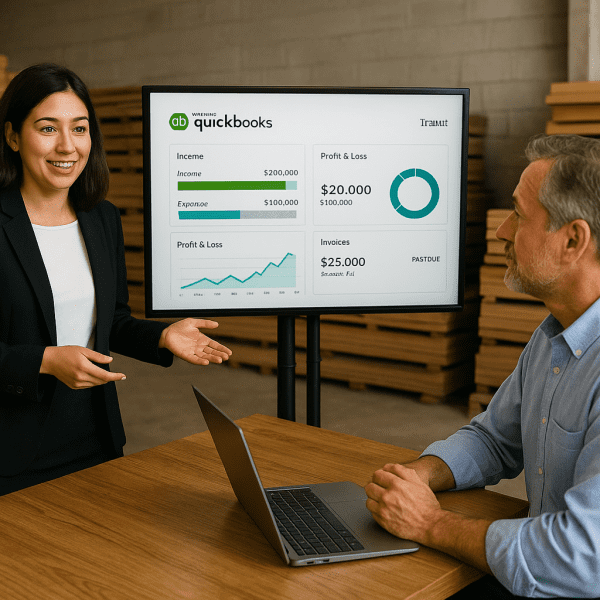

How to Prepare for 2025

To make the most of these trends:

- Diversify Your Portfolio: Spread your investments across sectors and regions to minimize risk.

- Stay Educated: Keep an eye on market news and emerging technologies to stay ahead of the curve.

- Seek Professional Advice: Consult with investment experts who can guide you toward opportunities aligned with your financial goals.

At Carlos Quiceno Financial Services, we specialize in identifying emerging investment opportunities tailored to your unique needs. Let us help you navigate the dynamic investment landscape of 2025. Contact us today to get started!