💰 Financial Education for Small Businesses: How to Manage Income, Expenses, and Cash Flow

Introduction

One of the biggest challenges for small businesses is not selling—it’s maintaining healthy finances. Many entrepreneurs start with great enthusiasm, but without proper control over income, expenses, and cash flow, their companies can quickly face financial difficulties.

At Carlos Quiceno Financial Services, we believe that financial education is the foundation for making smart decisions that strengthen stability and profitability.

1. Know and categorize your income

The first step in managing your finances is to understand exactly where your money comes from. Identify all sources of income: direct sales, services, commissions, or recurring payments.

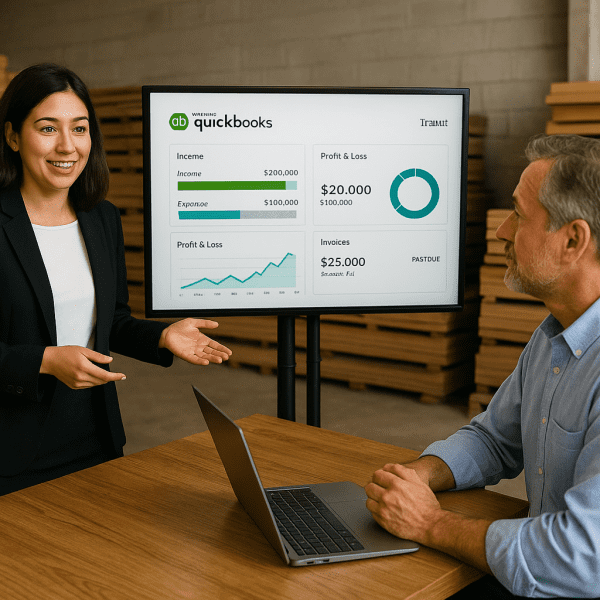

Use accounting tools like QuickBooks, which allow you to record and categorize your income automatically. This helps you visualize trends, forecast sales, and identify opportunities for growth.

2. Control and reduce your expenses

Operating expenses are inevitable—but good management prevents money leaks. Divide your expenses into three main categories:

- Fixed: rent, payroll, insurance.

- Variable: materials, transportation, commissions.

- Non-essential: purchases that can be postponed or eliminated.

Every month, review your financial reports and ask yourself: Does this expense really help my business grow? If not, consider cutting it or finding a more efficient alternative.

3. Manage your cash flow

Your cash flow represents the real movement of money in and out of your business. Having sales is not enough—you must ensure that more money comes in than goes out.

Keep an updated record of accounts receivable and accounts payable. With QuickBooks, you can automate payment reminders, generate daily reports, and monitor your cash flow in real time.

Remember: a positive cash flow is the clearest sign of a healthy and growing business.

4. Separate business and personal finances

A common mistake among small business owners is mixing personal and business finances. This creates confusion and makes it difficult to measure your company’s true performance.

Open a dedicated business bank account and keep all transactions separate. This will help you gain better control, simplify tax filing, and clearly track your business growth.

5. Work with financial experts

Having the support of professionals in bookkeeping and financial control can make a big difference. At Carlos Quiceno Financial Services, we help entrepreneurs and small businesses organize their finances, optimize accounting processes, and take advantage of digital tools to keep their operations profitable and sustainable.

Conclusion

Financial education isn’t just for large corporations—it’s essential for every business that wants to grow with confidence.

Learning to manage your income, expenses, and cash flow empowers you to make smarter decisions, plan ahead, and achieve financial stability.

At Carlos Quiceno Financial Services, we’re here to guide you step by step, helping you make your numbers work for you, not against you.